Supercharge Your

Finance Business

Streamline, Collaborate, and Maximize Growth!

Financial institutions suffer from departmental isolation, slow decisions, and varied client interactions without a centralized communication platform. This absence leads to lost wealth management opportunities and inefficient insurance claims processing, costing time, trust, and revenue. Bridging this gap is crucial now.

InstaVC empowers the legal industry with secure, scalable video collaboration tools. From remote client consultations and virtual hearings to internal meetings and legal training, InstaVC helps legal teams work smarter and serve clients better. Our all-in-one platform ensures seamless communication across locations, while protecting data integrity, maintaining compliance, and safeguarding confidentiality.

InstaVC helps financial institutions collaborate securely and efficiently. Our tailored communication tools enable real-time collaboration, centralized file sharing, and seamless system integration. InstaVC streamlines operations, breaks down silos, and ensures clear, consistent communication across teams and with clients—all while meeting industry standards.

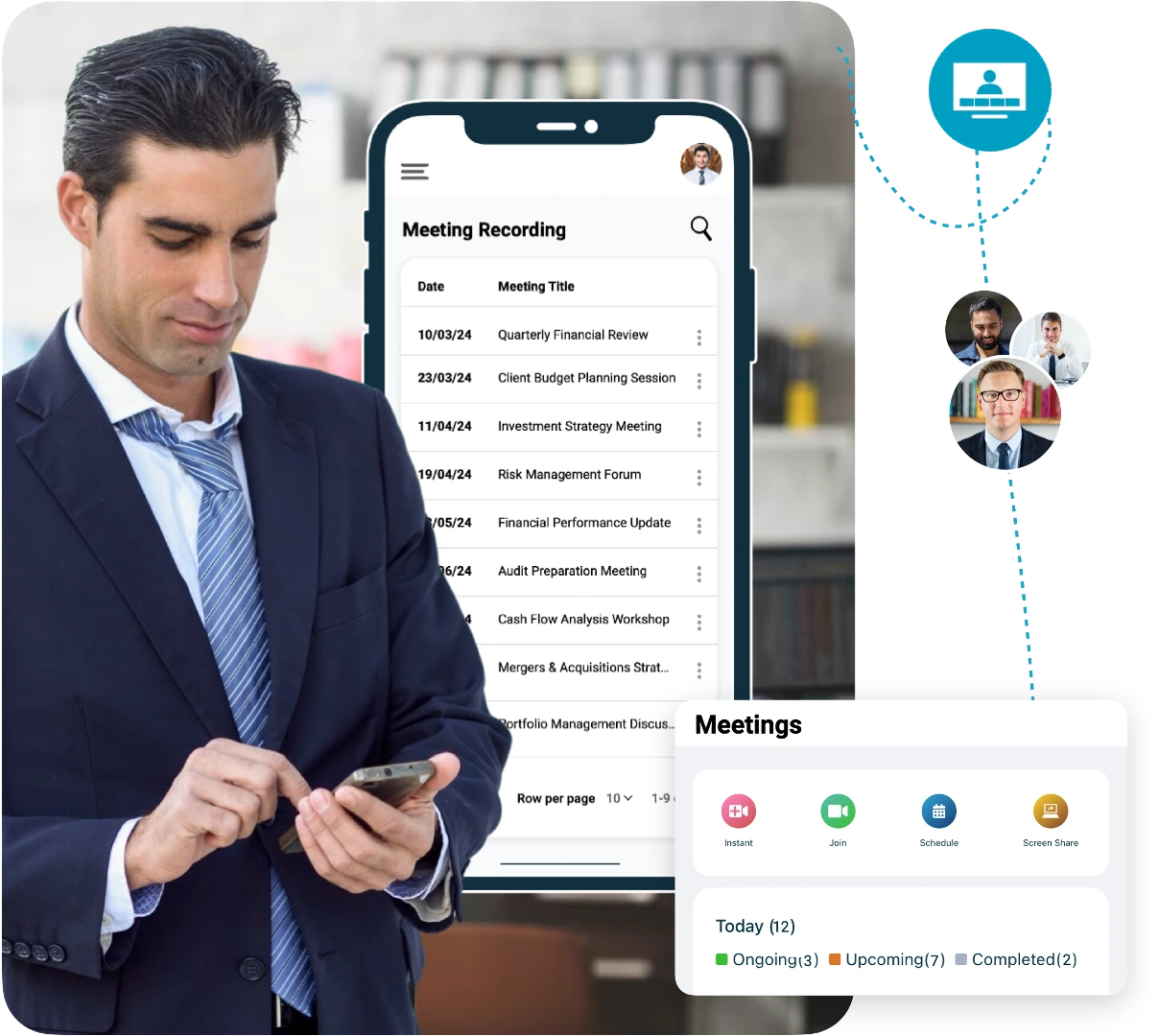

Unified Communication Across Departments: Facilitates cross-team communication through secure chat, calls, and video meetings, promoting real-time collaboration across locations and time zones.

Accelerates Fast Decision-Making: Efficiently handle customer issues, approvals, evaluations, and discussions with secure video/audio calls, minimizing reliance on emails and multiple platforms.

Enhances Customer Engagement: Offers secure video consultations to high-net-worth clients, loan applicants, and claimants, with integrated appointment scheduling for consistent customer experience.

Centralizes Training & Onboarding: Delivers virtual training, webinars, and certifications for advisors, agents, and new hires. Ensures consistent updates on compliance and product knowledge.

InstaVC provides encrypted, high-definition video meetings across all its platforms, enabling secure client interactions and internal communications for banks, NBFCs, and investment firms.

Banks, NBFCs, and insurance companies can deploy virtual branch solutions that enable face-to-face client servicing, real-time advisory, and automated backend workflows, all from the comfort of home

Manage partnerships, loan agreements, and investor contracts from initiation to execution using the powerful deal registration and contract modules

InstaVC’s centralized document and media storage empowers financial organizations to manage client records, contracts, compliance files, and internal assets securely and collaboratively

Enable continuous learning, internal collaboration, and knowledge sharing for finance professionals through integrated training and team tools.